Contractors

In the world of contracting, no two jobs are exactly alike. Because of this relative instability, contractors need access to a wide array of financing options. Some jobs will require a fix-and-flip loan, while others might need a line of credit. In most cases, you need access to fast cash, so you can’t wait around for traditional banks and other institutions. At Anchor Business Funding, we understand what it takes to keep your contracting business afloat, and we’re here to help. We work with a wide variety of lenders so that you can get the money you need when you need it. Let our experience and expertise match you to the right lender. Call us today to find out more.

Real Estate Investors

As a real estate investor, you understand that one of your biggest challenges is securing financing at the right time. Whether you’re waiting for a current property to sell or you’re looking to invest in a new development, you can’t afford to wait for traditional lenders. At Anchor Business Funding, we understand the challenges you face within this industry, so we’re equipped to help you. When you need funding in under a week, we can help you close. We have a vast network of lending resources, which means you can get access to a hard money loan, construction loan, or any other real estate development deal. Call us today to find out more and see how we can be your best asset..

SBA & 8a Businesses

If you’re familiar with the Small Business Administration (SBA), you know that it helps entrepreneurs and new business owners get financing. However, the Administration doesn’t offer funding itself – instead, it helps secure funds by backing lenders in case of default. Because of the way the SBA system works, it can be challenging to navigate. If you are an entrepreneur in a group that has been historically disadvantaged, you can qualify for the 8A program. At Anchor Business Funding, we understand the ins and outs of SBA loans, so we can help you find the right financing for your busines. Even if you’re not sure that you qualify, we can put you in touch with a variety of lenders to meet your needs. Contact us today to find out more.

Construction

Before beginning your new construction project, you’ll have to do a lot of planning and preparation. However, no matter how detailed or precise you are, there will always be setbacks and delays along the way. Unfortunately, if you don’t anticipate these obstacles, they can put the brakes on your project or shut down construction all together. The project isn’t done before the first payment is due on your loan. Construction loans are structured to pay out as you go so that these delays won’t result in excessive finance charges. Discover the benefit of construction loans by calling us today. Before breaking ground, we can be your best asset.

Restaurants

According to several studies, most restaurants will fail within the first four years. While there are many different variables at play, one of the most significant is a lack of proper financing. Unfortunately, too many new restaurant owners don’t understand the intricacies of accessing capital to ensure their success. At Anchor Business Funding, we can be your best resource to help get your venture off the ground, grow and thrive. Not only do we have access to a wide array of lenders, but we have the experience to help you make the right lender match for your business. Call us today to see how we can keep your restaurant cooking!

Restaurants

According to several studies, most restaurants will fail within the first four years. While there are many different variables at play, one of the most significant is a lack of proper financing. Unfortunately, too many new restaurant owners don’t understand the intricacies of accessing capital to ensure their success. At Anchor Business Funding, we can be your best resource to help get your venture off the ground, grow and thrive. Not only do we have access to a wide array of lenders, but we have the experience to help you make the right lender match for your business. Call us today to see how we can keep your restaurant cooking!

Franchise

Starting a business can be a daunting task, even in the best of conditions. In many cases, a surefire path to success can be opening a franchise. Since you have built-in brand recognition, along with a host of support tools and options, building your business is much more straightforward. That is, if you can get the money to open a new storefront. Thankfully, by working with us, we can connect you to a variety of franchise financing sources. Many of our lenders have a background in franchising and know how available cash is necessary to keep your franchise moving forward. Contact us today to find out more and see how we can help you realize your dream of owning or expanding upon a franchise.

Hotels

Being a hotel owner or operator can be difficult, even in the best of times. Because the hospitality business is so dependent on reliable financing and investment, it’s tough to navigate through the various funding options that are available to you. When talking about a new venture, how can you ensure that your capital stack is built correctly? What happens if you have to rebrand your hotel chain, including everything from the wallpaper to the sign out front? Fortunately, by working with us, you can avoid most of these problems. Not only do we have the experience and expertise necessary to help you increase cash flow, manage monthly payments and access funds when you need them in order to succeed, but we’re connected to a vast network of lenders. Call us to find out how we can assist your hotel business.

Hotels

Being a hotel owner or operator can be difficult, even in the best of times. Because the hospitality business is so dependent on reliable financing and investment, it’s tough to navigate through the various funding options that are available to you. When talking about a new venture, how can you ensure that your capital stack is built correctly? What happens if you have to rebrand your hotel chain, including everything from the wallpaper to the sign out front? Fortunately, by working with us, you can avoid most of these problems. Not only do we have the experience and expertise necessary to help you increase cash flow, manage monthly payments and access funds when you need them in order to succeed, but we’re connected to a vast network of lenders. Call us to find out how we can assist your hotel business.

Health Care

Running a clinic is much different than running any other business. While your goal is the same – to provide excellent service to your clients – you have to deal with a wide array of challenges and obstacles. Regulatory changes, staff turnover, outdated equipment and other problems require immediate and reliable financing to update equipment, meet standards, and move on. Fortunately, if you work with us, we make it easy to get the necessary funds to move past any bumps in the road. At Anchor Business Funding, we understand your objectives, no matter what kind of practice you have. From pediatrics to OB/GYN to dentistry, we’ve worked with a broad range of practitioners. Call us, and we can discuss your goals to get the right financing for your clinic.

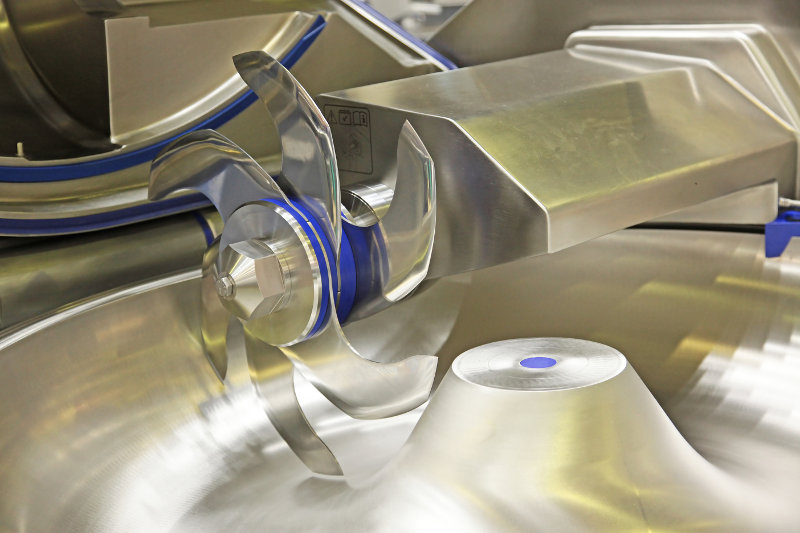

Manufacturing

These days, every component in the manufacturing pipeline is becoming more complicated. Globalization means that you have to find reliable ways of sourcing raw materials without sacrificing quality. On-demand shipping and fulfillment mean that you have a broader range of clients asking for highly specific items. No matter what kind of process you have, you need access to various financing options to maintain the flexibility to close deals quickly. Purchasing new equipment, securing better vendors within the supply chain – whatever challenge you’re facing, we’re here to help. Contact us today to see how we can get you the funds you need to upgrade your operations. Even better, we can adapt to support your financial plan, including budget and time constraints.

Manufacturing

These days, every component in the manufacturing pipeline is becoming more complicated. Globalization means that you have to find reliable ways of sourcing raw materials without sacrificing quality. On-demand shipping and fulfillment mean that you have a broader range of clients asking for highly specific items. No matter what kind of process you have, you need access to various financing options to maintain the flexibility to close deals quickly. Purchasing new equipment, securing better vendors within the supply chain – whatever challenge you’re facing, we’re here to help. Contact us today to see how we can get you the funds you need to upgrade your operations. Even better, we can adapt to support your financial plan, including budget and time constraints.

Churches

Typically, churches rely on the donations of their congregations to focus on issues like upgrades and renovations. However, when you need a new roof, to acquire land or to build a school, asking for a lump sum donation may be too much all at once. In these instances, financing can bridge the gap and donors can support your good work over time. Unfortunately, securing a loan or line of credit as a church can be more than a little challenging. Thankfully, we’re here to help. At Anchor Business Funding, we understand how to navigate the various pitfalls that come from financing a church project. Rather than hosting a bake sale or asking your followers to give more, you can get funds quickly and easily. Call us today to find out how.

Nonprofit

Ideally, when running a nonprofit, you will experience such success that you have to expand your operations. However, when that time comes, how are you going to pay for added administrative costs and overhead? In many cases, soliciting donations may not be appropriate, which can put you in a bind. Successful fundraising relies on fulfilling your mission. Rather than relying on volunteer work or fundraisers, funding allows you to deliver programming, fulfill your mission, generate cash flow and inspire donations. We know what it takes to build your nonprofit and bring it to the next level. We have a vast network of financing partners who can support your development plan so you can grow. Call us today to find out more.

Nonprofit

Ideally, when running a nonprofit, you will experience such success that you have to expand your operations. However, when that time comes, how are you going to pay for added administrative costs and overhead? In many cases, soliciting donations may not be appropriate, which can put you in a bind. Successful fundraising relies on fulfilling your mission. Rather than relying on volunteer work or fundraisers, funding allows you to deliver programming, fulfill your mission, generate cash flow and inspire donations. We know what it takes to build your nonprofit and bring it to the next level. We have a vast network of financing partners who can support your development plan so you can grow. Call us today to find out more.

Commercial & Industrial

For most commercial and/or industrial companies, the most significant challenge is straddling the line between streamlining costs and maintaining high operational standards. Unfortunately, trying to get the right funding for various upgrades and advancements can be more than a little overwhelming, particularly if you don’t know where to turn. Thankfully, we can assist your business today. Leverage your current equipment to buy new machinery or leverage raw materials for quick cash. No matter your market or industry, we can find the right funding solution for you. Call us to learn more about our lending opportunities.

Charter Schools

It can be a challenge to get the right funding for a charter school. On one hand, you need to maintain high standards for your special programs to entice new students to enroll. On the other, if you don’t have sufficient attendance, your funding stagnates. Unfortunately, for many charter schools, this balance can create a vicious cycle that’s almost impossible to break. That is unless they have access to the funds necessary to continue to grow. Running a charter school comes with many hurdles and pitfalls, but financing shouldn’t be one of them. At Anchor Business Funding, we understand what it takes to get funded. See how by contacting us today.

Let's Build Your Funding Portfolio Together

Your business needs the right funding to advance. Work with Anchor Business Funding to identify and source the right funds at the right price to keep your business moving forward.

Powered by CLBI